Heloc payment calculator bank of america

As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. August 31 202210-Year HELOC Rates Reach A 52-Week High By Andrea Riquier Forbes Advisor Staff HELOC Rates For August 29 2022.

11 Things Everyone Starting The Home Buying Process Needs To Know Home Buying Process Home Equity Loan Home Mortgage

Average HELOC Rates.

. 10-Year HELOC Rates Move Up To A New High. LTV Loan to Value. For lines of credit up to 500000 we will lend up to 85 of the total equity in your home for a new HELOC secured by a first or second lien.

Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. The maximum line amount is 1 million. As of 08312022 this variable HELOC APR would have been 549 APR for 80 LTV.

HELOCs have a 10-year draw. The APR will vary with Prime Rate the index as published in the Wall Street Journal. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

At the same time the rate on a 20-year HELOC is 715 down 11 basis points. 1 There are no prepayment penalties or balance requirements plus a quick closing through Schwab Banks home equity lending program provided by Rocket. APR Annual Percentage Rate.

So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half. Every home loan situation is different so its hard to estimate how long your specific home mortgage process will take. For the HELOC the Rate is subject to a minimum of 399 and the maximum APR.

Bank of America offers one of the best HELOCs with no application fee no closing costs on up to 1000000 and no annual fee. Some of the factors that affect the timeline include the type and terms of the home loan youre requesting the types of documentation required in order to secure the loan and the amount of time it takes to provide your lender with those documents. For example if youre interested in paying off your mortgage off in 15 years as opposed to 30 you generally need a monthly payment that is 15X your typical mortgage payment.

As the second-largest bank in the country Bank of America offers HELOCs on properties in all 50 states plus Washington DC. Introductory rate for the line of credit as low as 399 for the first year then the APR will vary for the remaining life of the loan. Bank of Americas HELOC has a minimum credit line amount of 15000 in some locations but the minimum is generally 25000.

Our maximum loan amounts and available equity requirements vary by property type. Use the equity youve built to get a competitive-rate home equity line of credit HELOC. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Boa Customized Cash Rewards Credit Card Review Forbes Advisor

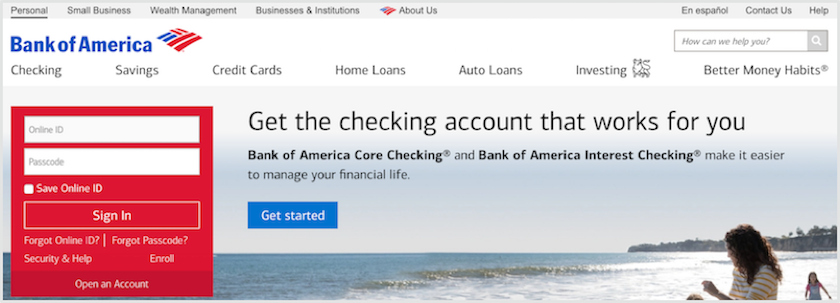

Bank Of America Checking Accounts Bankrate

Bank Of America Personal Loans 2022 What S Offered

Bank Of America Heloc Review September 2022 Is It A Good Idea Finder

Bank Of America Mortgage Lender Review Nextadvisor With Time

Bank Of America Premium Rewards Credit Card 2022 Review Forbes Advisor

Bank Of America Business Advantage Cash Rewards 2022 Review Forbes Advisor

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Loans For Bad Credit Bad Credit Mortgage No Credit Loans

Bank Of America Travel Rewards Card Review Nextadvisor With Time

Bank Of America Home Equity Line Of Credit Review Lendedu

Bank Of America Cd Rates Bankrate

Mortgage Loan To Get Debt To Income Ratio Line Of Credit Home Equity

Bank Of America Business Advantage Unlimited Cash Rewards Credit Card Review Forbes Advisor

Bank Of America Unlimited Cash Rewards Secured Card Review Nextadvisor With Time

Bank Of America Cash Rewards Card Review Nextadvisor With Time

Bank Of America Heloc Review September 2022 Is It A Good Idea Finder

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff